Iowa Department of Revenue Issues Key Guidance on DPAD, Like-Kind Exchange, and 2019 Income Tax Brackets

For tax year 2018, Iowa has coupled only with selected federal changes. With those exceptions, Iowa tax law looks to the Internal Revenue Code as it existed on January 1, 2015. This non-conformity has presented some challenges. Recently, the Iowa Department of Revenue issued guidance on several provisions that have created the greatest number of questions. Yesterday, the Department also issued its 2019 tables for income tax brackets, interest rates, and standard deductions. This article summarizes these notices.

DPAD – Alive and Well in Iowa in 2018

The Tax Cuts and Jobs Act repealed federal DPAD (IRC § 199) for tax years beginning on or after January 1, 2018. Iowa, however, has not coupled with this repeal for tax years beginning on or after January 1, 2018, but before January 1, 2019. Consequently, DPAD is available to Iowa taxpayers for tax year 2018. This has created many questions given the fact that Iowa has never had its own Form 8903. The federal DPAD has always just modified Iowa income.

Iowa has now issued guidance to taxpayers on how to calculate DPAD for tax year 2018. The guidance states that Iowa taxpayers should use the federal Form 8903 as a worksheet, and should retain a copy of that worksheet for their records. Furthermore, the DPAD for Iowa taxpayers must be calculated using the Internal Revenue Code as it existed on January 1, 2015. Thus, taxpayers are instructed to make these adjustments, in particular:

- Federal bonus depreciation is not allowed for Iowa tax purposes.

- Federal section 179 deduction is limited for Iowa tax purposes.

- Iowa has not conformed to DPAD changes made in the 2015 PATH Act relating to the treatment of transportation costs of independent refiners (previous IRC § 199(c)(3)(C)).

- Iowa has not conformed to the DPAD changes made by the PATH Act or in the 2018 Bipartisan Budget Act relating to the extension beyond 2014 of the DPAD allowable with respect to activities in Puerto Rico.

The guidance states that to the extent any nonconformity adjustments affect the calculation of DPAD (including the calculation of AGI or federal taxable income on line 11 of Form 8903), the taxpayer must make the proper adjustment.

Finally, taxpayers are instructed to follow the same procedures that were used for calculating the federal DPAD prior to its repeal, including:

- Partnerships and S corporations determine DPAD at the owner level and report that information to the owners

- Trusts, estates, and agricultural cooperatives wishing to distribute DPAD to beneficiaries and patrons must use the same calculations as previously required under federal law

- The new IRC § 199A(g) is not available to Iowa taxpayers in 2018, but cooperatives may be able to calculate their DPAD for Iowa purposes using similar amounts and calculations as they do for the new federal deduction, with the exception of making necessary nonconformity adjustments. C corporation patrons are not eligible for the 199A(g) pass-through deduction.

Taxpayers are instructed use the instructions for federal Form 8903 (as revised in January 2013) if they have questions regarding the Iowa DPAD calculation. But this new procedure will not be in place long. Iowa too bids farewell to DPAD in tax year 2019.

Like-Kind Exchange – Not Just for Real Property in Iowa in 2018 and 2019

The Tax Cuts and Jobs Act restricted IRC § 1031 exchange income deferral to real property only for exchanges completed after 2017. Alas, Iowa in its nonconformity, has not presently coupled with this change. In an attempt to help Iowans who cannot take enough Section 179 (due to Iowa’s lack of conformity with expanded federal provisions) in tax years 2018 and 2019 to ward off large recapture tax liability in the face of a trade, Iowa has created some transitional assistance.

2017 (fiscal-year filers) and 2018

Iowa retains IRC § 1031 treatment for personal property in tax years 2017 (fiscal year) and 2018, as it existed under prior federal law. This means that like-kind, tax deferral treatment is mandatory for all taxpayers for qualifying trades in these tax years.

2019

For individuals, estates or trusts, and pass-through entities other than a corporation or financial institution, transactions involving the disposition and acquisition of personal property completed during tax year 2019 may, at the election of the taxpayer, be treated as a like-kind exchange of personal property for Iowa tax purposes. To be eligible for this election, the exchange must have been eligible for like-kind treatment under prior federal law. The guidance states that corporations and financial institutions are not eligible for deferral of gain or loss for personal property exchanges made during tax year 2019. These exchanges will be treated as they are under current federal law.

2020

All transactions occurring in tax years beginning on or after January 1, 2020 that involve like-kind personal property will not be eligible for IRC § 1031 deferral treatment. They will be treated as they are under current federal law.

Reporting these Transactions

The Department has created a new worksheet, IA 8824, for use in tax years 2017 and 2018, to assist taxpayers in calculating necessary adjustments and documenting their personal property like-kind exchanges for Iowa purposes.

Specific rules on the election for tax year 2019 will be provided by the Department in the future.

2019 Income Tax Brackets, Interest Rates, and Standard Deductions

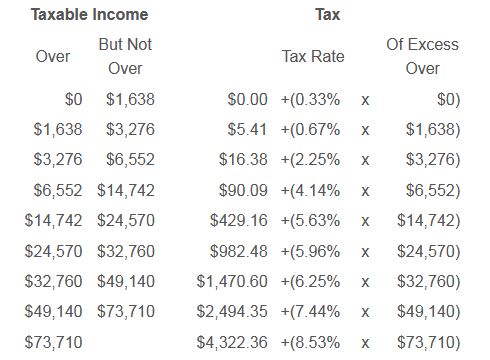

On October 30, 2018, the Iowa Department of Revenue announced the 2019 individual income tax brackets, interest rates, and standard deductions. They are as follows:

Individual Income Tax Brackets

The new table reflects the lower rates implemented by Iowa SF 2417.

Standard Deduction

The Iowa 2019 standard deductions are:

- $2,080 for single taxpayers

- $2,080 for married filing separately

- $5,120 for married filing jointly

Interest Rates

Beginning January 1, 2019, the interest rate for taxpayers with overdue payments will be:

- 7.0% annually

- 0.6% monthly

- 0.019178% daily